The Mauritius Film Rebate Scheme2 Film Rebate Schemes in Mauritius

1) Mauritius Film Cash Rebate Scheme: A Leading Initiative Since July 2016

Recognized globally for its robust Film Cash Rebate Scheme, Mauritius has positioned itself as a premier destination for filmmaking since July 2016. This dynamic initiative extends its support to an array of productions including Feature Films, Premier TV Drama series, Engaging Documentaries, TV Reality Series, Aesthetic Music Videos, Innovative Games, and Riveting Single Drama Series.

The Mauritian Government’s commitment to promoting quality filmmaking is evident in its generous offering: a rebate of up to 40% on Qualified Production Expenditures (QPE). Productions that boast a filming schedule of 90% or more in Mauritius are immediately eligible for the full 40% rebate.

Identical Pictures: A Testament to Excellence in the Mauritian Filming Landscape

With a successful track record of 20 approved rebate applications over a mere 5-year span, and having secured a remarkable 39% Film Rebate – the highest of its kind – Identical Pictures has established itself as a frontrunner amongst film production companies in Mauritius. Our forte? Maximizing returns on the Mauritian Film Rebate for our esteemed clients.

This pioneering Mauritius Film Rebate Scheme is an esteemed collaboration between the Economic Development Board (EDB) and the Mauritius Film Development Corporation (MFDC). Designed to cater to both domestic and global filmmakers, the scheme’s primary objective is multifaceted: it seeks to captivate filmmakers’ interests, prompt them to choose Mauritius as their prime filming locale, foster job creation, skill development, and essentially spotlight Mauritius on the global stage.

2) The New Mauritius Tax Film Rebate since July 2023: Double Deduction Benefits

Mauritius isn’t just offering an attractive Film Cash Rebate; it’s going a step further to incentivise local businesses to actively partake in the burgeoning film industry.

At the core of this enticing proposition is the “Double Deduction of Expenditure” provision. Local companies that dive into the financing, sponsorship, marketing, or even distribution of an approved film project under the Film Rebate Scheme can enjoy a tax relief that’s nothing short of extraordinary. Specifically, these companies are entitled to a 200% deduction on the amounts they invest in such projects.

But there’s a caveat, one that ensures the promotion of the Mauritian film landscape. For a film to be eligible for this tax relief, it must champion Mauritius as its primary shooting destination. In concrete terms, at least 90% of the film should be produced within the picturesque confines of Mauritius.

Whether the final production is destined for traditional theatrical release or the ever-popular media streaming platforms, the message is clear: Invest in Mauritian films, and the returns, both financially and in terms of fostering a rich cinematic culture, are bound to be significant.

Film Finance

We are able to provide a range of financial opportunities for projects coming to Mauritius. These include the Mauritius Film Rebate Incentive.

Through our relationship with major Banks on the island, we can also offer the cashflowing of the Rebate, at extremely competitive interest rates.

We can also provide Gap finance and cashflow for international pre-sales.

Each project will be looked at on a case-by-case basis.

The Mauritius Film Rebate Scheme provides up to 40% rebate for qualifying expenditures, such as:

- Travel/Shipping to and from Mauritius (by air and by sea)

- Accommodation in Mauritius

- Rental of local film equipment

- Professional services such as insurance, accounting and audit services

- Production service company fees

- Post-production services

- National & International Cast and Crew costs

- Flights and Ground transport

- Catering services

- Props, Sets and Wardrobe purchased and or rented in Mauritius

- and many more.

Application and Claim Procedures

To apply for the rebate, an application should be submitted by a locally registered production services company to the Economic Development Board at least four weeks before filming. Supporting documents include:

- A synopsis of the project

- An Overview of the Project including the beneficial exposure to Mauritius, target audience, and distribution plan, as appropriate

- Filmography of Producer showing a track record of at least five years

- CVs of the Director and Lead Cast

- Viable Financial Plan and details of any third-party financiers including any letters of interest/commitment from those parties, where applicable

- Detailed Budget in Mauritian Rupees

- Detailed breakdown of Mauritian Spend (Qualified Production Expenditure)

- Certificate of incorporation of the local domestic company (SPV) with a local director which Identical Pictures can provide

- Global Schedule and detailed location breakdown

- List of cast and crew members and nationalities

- and many more.

Eligible Productions and Qualifying Expenditures

Productions eligible for up to 40% rebate include:

- Feature Films with minimum QPE of USD 1,000,000

- High-end TV Drama Series or Single Drama with minimum QPE of USD 150,000 per episode

- Post-production with minimum QPE of USD 150,000

Productions eligible for 30% rebate include:

- Feature Film (with or without Animation) with minimum QPE of USD 100,000 (Foreign Production) and USD 50,000 (Local Production)

- TV Drama Series or Single Drama USD 20,000 per episode

- TV Documentary Programme with minimum QPE of USD 20,000

- Music Video with minimum QPE of USD 30,000 (Foreign Production) and USD 15,000 (Local Production)

- Dubbing Project with minimum QPE of USD 30,000

- Post-production with minimum QPE of USD 30,000

On Film Productions where the Above the Line (ATL) costs are higher than the Below the Line (BTL) costs, there is a 40% Cap on the ABL costs.

Services

Evaluation of Film Project for the Rebate Scheme | Movie Magic Budgeting | Movie Magic Scheduling | Presenting the Film Project to the EDB team | Setting up Local SPV | Setting Bank Account of the SPV | Provide a Mauritian Director for the SPV | Creating the Application for the Mauritian Rebate Scheme | Providing Cash Flow Financing | Providing Gap Financing | Providing Equity Financing

Share on social media

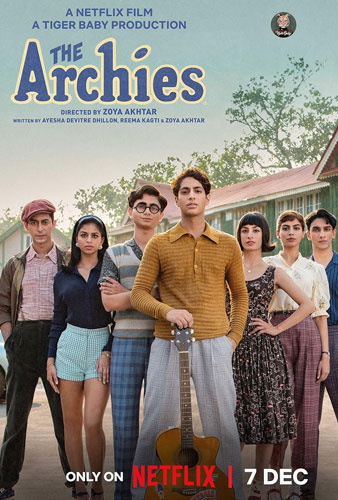

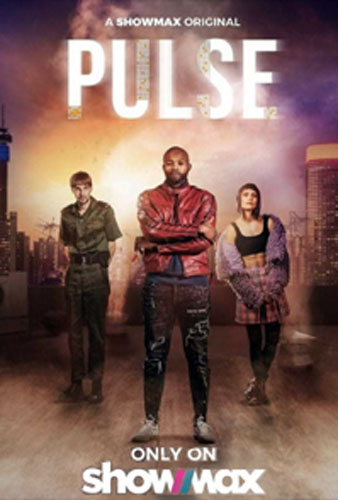

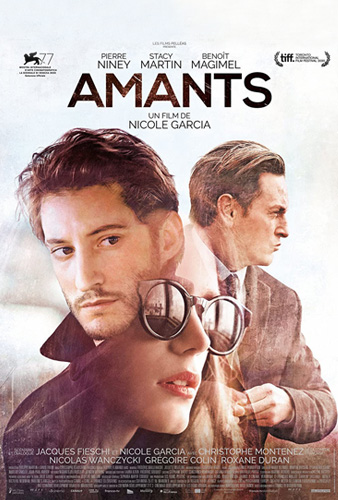

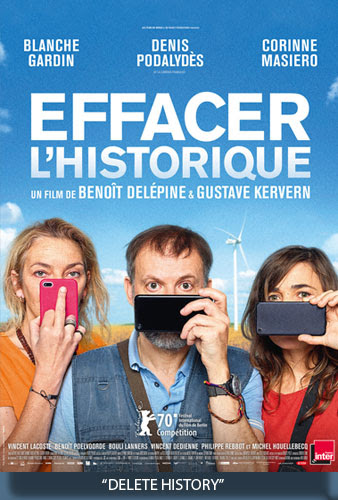

Approved Film Rebate Projects, Produced by Identical Pictures